[Narrator] A decade in the making, next-level risk management has come to New York. And it's as easy as 10, 20 and 30% buffers. Introducing Allianz Index Advantage+ New York Variable Annuity, a new product that helps make protecting your clients’ hard-earned money easier. That’s because, in addition to a level of protection through multiple index options, tax-deferred growth potential, a variety of annuity payout options, and a death benefit during the accumulation phase, Allianz Index Advantage+ New York provides investors with diverse protection levels through its buffers, bear market opportunities with a new index strategy, and enhanced flexibility, all for no product fee. Ready to hear more?

[On-screen disclosure] Withdrawals will reduce the contract value and the value of any potential protection benefits. Withdrawals taken with the contract withdrawal charge schedule will be subject to a withdrawal charge. All withdrawals are subject to ordinary income teax and, if taken prior to age 59½ may be subject to a 10% federal additional tax. [End of on-screen disclosure]

[On-screen disclosure] An annual 1.25% Mortality and Expense Risk Charge will be charged on the variable option, a $50 annual Contract Maintenance Charge if contract value is less than $100,000, and potential withdrawal charges during the 6-year withdrawal charge schedule. [End of on-screen disclosure]

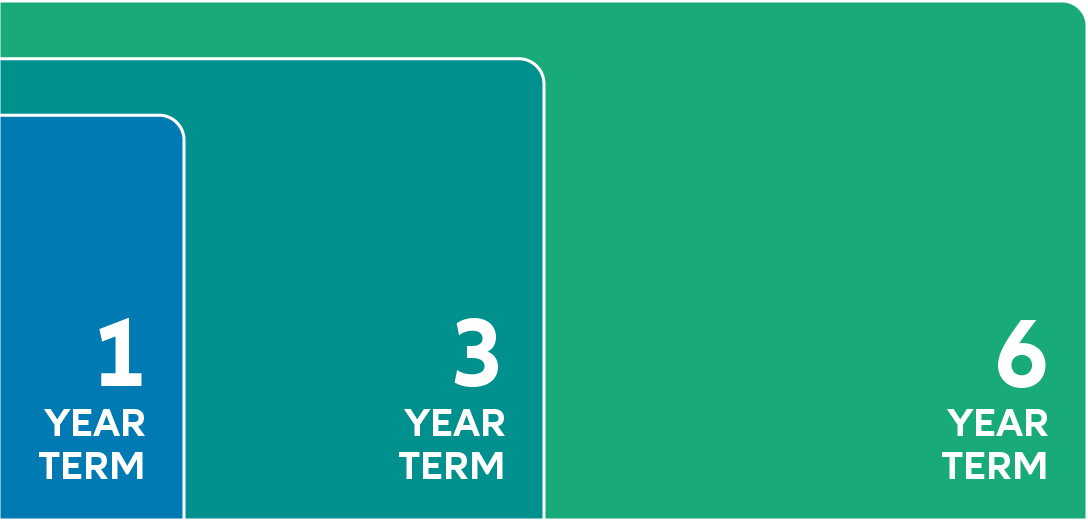

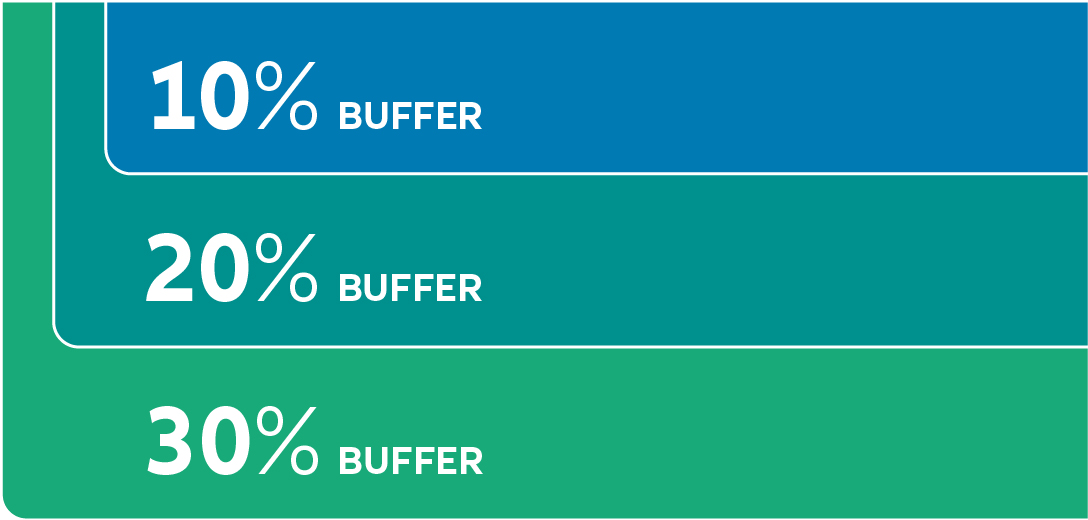

First, let's look at the features of two of our index strategy options. For the first time ever, with the existing Index Performance Strategy crediting method, investors have the same choice of buffer options across all three of its term lengths. It's not just the diverse buffers available with the Index Performance Strategy.

[On-screen disclosure] Your clients could experience a loss during a term if the index declines more than the level of downside protection provided by the buffer. Your clients may not be able to participate fully in a market recovery if the index option is capped in subsequent terms. Losses in excess of the buffer will reduce your clients' contract value. [End of on-screen disclosure]

With the new Index Dual Precision Strategy, investors have the potential to earn positive performance credits even in a down market. Let's see how this works using a hypothetical one-year term example. With the Index Dual Precision Strategy, there are four possible scenarios. If the index return at the end of the term is positive, zero, or negative but within the buffer, the trigger rate would be applied for the contract owner, resulting in a positive performance credit equal to the trigger rate. If there's a negative index return and it exceeds the buffer, the trigger rate would not be applied, and there would be a negative performance credit equal to the amount of the negative return in excess of the buffer.

[On-screen disclosures]

This hypothetical example shows how the Index Dual Precision Strategy index options might work in different market index environments and assumes no change in the hypothetical trigger rate. It does not predict or project the actual performance of the Allianz Index Advantage+ New York™ Variable Annuity with the Index Dual Precision Strategy index options. This example does not reflect deductions for contract fees and expenses which, if included, would lower the results shown.

Your clients could experience a loss during a term if the index declines more than the level of downside protection of the buffer. Your clients may not be able to participate fully in a market recovery due to the trigger rates limit on upside potential in subsequent terms.

Trigger rates may be different from what is represented in the example.

Trigger rates can be different between newly issued contracts and inforce contracts, and they can be different between inforce contracts issued on different days and in different years. Trigger rates can also be different for each index option. Trigger rates are subject to change on each new Term Start Date, and will never be less than the minimum trigger rate.

Amounts invested in the index strategy must be held for the full term before they can recieve a Performance Credit. The Daily Adjustment may cause your client to lose principal and previous earnings even if index return has been positive since the Term Start Date.

[End of on-screen disclosures]

You can see how this index strategy can offer performance potential, even in a down market, with a level of protection. But that's not all. To top it off, our continued innovation means enhanced flexibility for your clients, with our industry-leading Performance Lock and early reallocation features.

[On-screen disclosure] Executing a Performance Lock may result in your client recieving less than the Performance Credit they would have recieved had you or your client not locked the Index Option. It is possible to lock in a negative return. We will not provide advice or notify you or your client regarding whether you or your client should execute a Performance Lock or Early Reallocation, the optimal time to do so, or if you or your client executes a Performance Lock or Early Reallocation at a sub-optimal time. We are not responsible for any losses related to the decision whether or not to execute a Performance Lock or Early Reallocation. [End of on-screen disclosure]

If you're interested in learning more about Allianz Index Advantage+ New York™, visit allianzlife.com/AdvantagePlusNY, or call the Sales Desk at 800.542.5427.

[On-screen disclosures]

Registered index-linked annuities are subject to investment risk, including possible loss of principal. Investment returns and principal value will fluctuate with market conditions so that units, upon distribution, may be worth more or less than the original cost.

For more complete information about registered index-linked annuities and the variable option, call Allianz Life Financial Services LLC at 800. 542.5427 for a prospectus. The prospectuses contain details on investment objectives, risks, fees, and expenses, as well as other information about the registered index-linked annuity and the variable option, which your clients should carefully consider. Encourage your clients to read the prospectuses thoroughly before sending money.

Although an index or indexes will affect Index Option Values, the Index Options do not directly participate in any stock or equity investment and are not a direct investment in an index.

Withdrawals will reduce the contract value and the value of any potential protection benefits. Withdrawals taken within the contract withdrawal charge schedule will be subject to a withdrawal charge. All withdrawals are subject to ordinary income tax and, if taken prior to age 59½, may be subject to a 10% federal additional tax.

• Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not apply to the performance of the variable subaccount, which will fluctuate with market conditions.

Products are issued by Allianz Life Insurance Company of New York, 1633 Broadway, 42nd Floor, New York, NY 10019-7585, and distributed by its affiliate, Allianz Life Financial Services, LLC, member FINRA, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

Product and features are available only in the state of New York.

For broker/dealer use only – not for use with the public

[End of on-screen disclosures]