This content is for general informational purposes only. It is not intended to provide fiduciary, tax, or legal advice and cannot be used to avoid tax penalties; nor is it intended to market, promote, or recommend any tax plan or arrangement. Allianz Life Insurance Company of North America, Allianz Life Insurance Company of New York, their affiliates, and their employees and representatives do not give legal or tax advice or advice related to Medicare or Social Security benefits. You are encouraged to consult with your own legal, tax, and financial professionals for specific advice or product recommendations, or to go to your local Social Security Administration office regarding your particular situation. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America and do not apply to the performance of the variable subaccounts, which will fluctuate with market conditions.

Risk management consultants market risk management solutions and provide education and information related to products they market and do not provide financial or investment advice.

1 Allianz Investment Management LLC (AllianzIM) is a registered investment adviser and wholly owned subsidiary of Allianz Life Insurance Company of North America.

2 Increasing income opportunities are provided through an additional-cost rider.

3 Allianz Life Insurance Company of North America does not provide financial planning services.

4 The Advanced Markets team does not provide tax or legal advice.

5 Concierge Desk members are securities registered with the Leaders Group, Inc., member FINRA/SIPC.

6 Wink's Sales & Market Report, Sales Data Query, 1Q 2000 – 4Q 2023.

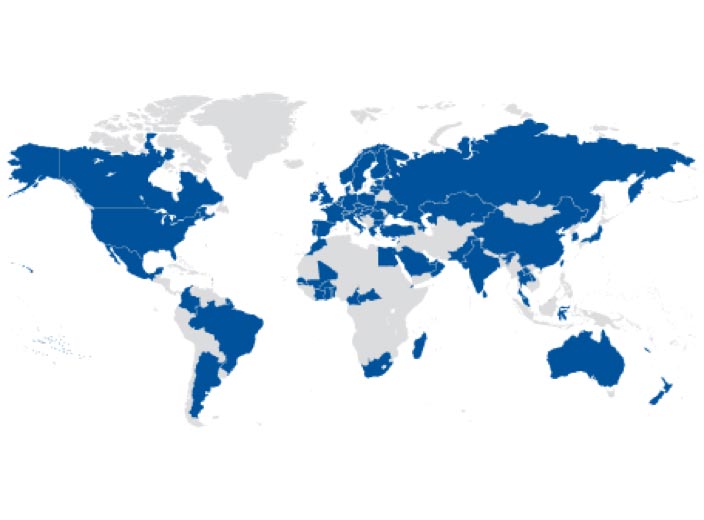

7 Fortune Global 500, August 2023. Ranking based on revenue.

8 Allianz SE: TAI/P&I 500, October 2023. Ranked by total AUM.

9 Forbes Global 2000: The World’s Largest Insurance Companies in 2023, June 2023.

For ETFs:

Investing involves risk, including possible loss of principal. There is no guarantee the funds will achieve their investment objectives and may not be suitable for all investors.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus with this and other information about the Fund, please call 877.429.3837 or visit www.allianzimetfs.com and review the prospectus. Investors should read the prospectus before investing.

ETFs are distributed by Foreside Fund Services, LLC. Allianz Investment Management LLC and Allianz Life Insurance Company of North America are not affiliated with Foreside Fund Services, LLC.