[Grandpa] This is my grandson, Jacob. Sorry, he wants to be called Jake.

[Mom] This is our daughter, Sara. She wants to learn computer software development and network engineering. She's the brains of the family.

[Grandpa] At high school graduation, I was so happy for Jake. But even then, I knew, okay, the clock is starting. He's going to be going away to college soon.

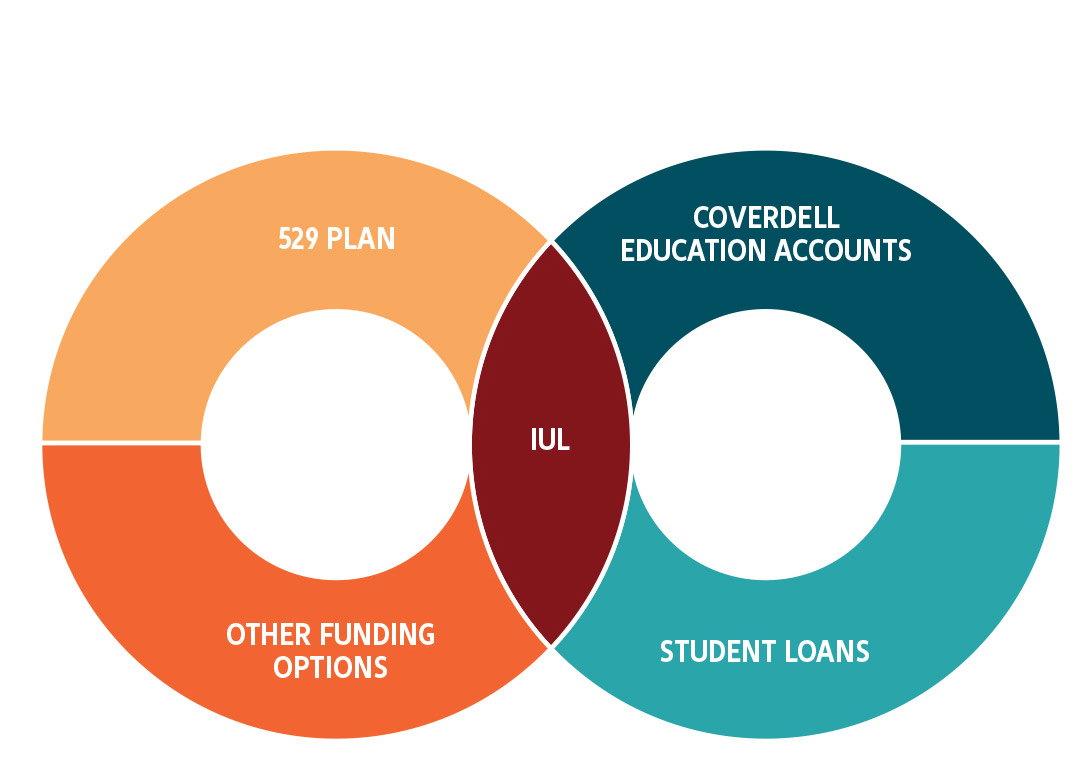

[Mom] Sara's got a small scholarship, but still, the cost of college is just crazy. Tuition, books, room and board. I worry about Sara racking up so much debt in school loans. But we have a good financial person. She had a great idea about using life insurance as part of an overall financial strategy.

[Grandpa] Back when Jake was in middle school, we put money into a type of life insurance called indexed universal life.

[Mom] IUL for short. We bought it for the long-term financial protection it gives our family, with a death benefit in case something happens to me or Sara's father. But that's not all.

[On-screen disclosure] The death benefit is generally income-tax-free when passed on to beneficiaries. [End of on-screen disclosure]

[Grandpa] With this kind of insurance, my premiums have the potential to accumulate in value over time, and we've done pretty good all things considered.

[On-screen disclosure] The policy’s accumulation value can earn interest in two ways – at a predictable, fixed rate, or based on the annual positive return of an external market index when you allocate to one or more index allocation options, but you’re not actually participating in the market. Fees and charges will reduce the accumulation value. [End of on-screen disclosure]

[Mom] We bought the IUL policy back when Sara wasn't even thinking about college. But I was. It was a way to have the opportunity to build up more funds to help with her tuition.

[On-screen disclosure] Policy loans and withdrawals will reduce the available cash value and death benefit and may cause unintended consequences, including lapse or taxable events. There is no guarantee the policy will earn sufficient interest to support a loan strategy. Please see full loan and withdrawal disclosure within this video for details. [End of on-screen disclosure]

[Grandpa] I can access the policy's available cash value accumulation any time I like, through a policy loan or withdrawal. And now that Jake's in college, guess what we're using it for?

[Mom] I tell Sara she's getting the Number One Daughter scholarship, and because the money's coming through loans or withdrawals from my policy, as of now, there's generally no complex eligibility or income limits we have to worry about.

[On-screen disclosure] Withdrawals from the cash value do generally count as income when applying for other types of financial aid. Please refer to the university or college for further information regarding eligibility requirements, as they may vary by school. [End of on-screen disclosure]

[Grandpa] Of course, I made sure my grandson knows that, the way things stand now, any policy loans they take out for him generally won't affect his eligibility to get other financial aid. That's a hint, Jake.

[Mom] The other day, Sara said to me maybe she'll take a year off and try professional skateboarding. I said, "Sara, my darling, it's your life. You can make your own choices, but if you're not going to college, you're not seeing that money. I can use it for anything I want, like a trip to Italy."

[Narrator] Life insurance in a college funding strategy can provide tax-deferred accumulation potential with a level of protection from market losses, access to available cash value to help with tuition or other financial needs, and an income-tax-free death benefit for the financial protection of loved ones or beneficiaries.

[Grandpa] Jake, you're going to be the best investment we ever made.

[Mom] Make me proud, Sara.

[On-screen disclosures]

Policy loans and withdrawals will reduce the available cash value and death benefit and may cause the policy to lapse, or affect guarantees against lapse. Withdrawals in excess of premiums paid will be subject to ordinary income tax. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. If a policy is a modified endowment contract (MEC), policy loans and withdrawals will be taxable as ordinary income to the extent there are earnings in the policy. If any of these features are exercised prior to age 59½ on a MEC, a 10% federal additional tax may be imposed. Tax laws are subject to change and you should consult a tax professional.

This content must be accompanied by the "Understanding indexed universal life insurance" consumer brochure (M-3959) or appropriate product brochure.

Life insurance can be a powerful way to help provide for your next generation's future. Talk to your financial professional about how an IUL policy works, and how it can help fill the gaps in your college funding strategy.

Life insurance policies require health and financial underwriting and have certain fees and charges associated with them that pay for the death benefit, underwriting expenses, and issuing and administering the policy. These policy charges would continue to be deducted, and loans will reduce the policy’s cash value and could cause the policy to lapse. You’ll want to carefully monitor your policy’s values and make sure your policy is properly funded so it doesn’t lapse.

Guarantees are backed by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America (Allianz).

Products are issued by Allianz Life Insurance Company of North America, PO Box 59060, Minneapolis, MN 55459-0060.

Product and feature availability may vary by state and broker/dealer.

This content does not apply in the state of New York.

M-7514 (R-5/2025)

P64339

[End of on-screen disclosures]