The uncontrollable retirement risks

For many years, retirement planning was all about setting a savings goal and hitting that number. However, when it comes time to retire, many participants aren’t comfortable spending down those assets. In fact, a recent study found that most current retirees still had 80% of their pre-retirement savings after two decades of retirement.¹

While guidance like the four percent rule exists to help people determine a safe withdrawal rate, it doesn’t come with any guarantees. At the same time, there are a number of unknown retirement risks, which could upend the rules, such as:

- Longevity risk: We don’t know how long we’ll live.

- Equity return risk: We don’t know how markets will perform in the future.

- Inflation risk: We expect our income needs to increase to account for inflation, but we don’t know by how much.

- Market shock risk: What if there is a significant market downturn early in a client’s income phase?

Personal spending shocks can also happen. A medical diagnosis could lead to costly health or long-term care bills. A divorce could disrupt financial planning as a person transitions from a dual-income to a single source of income. With all of these risks in mind, it is no wonder that participants are hesitant about funding essential retirement needs with income that is solely reliant on market returns.

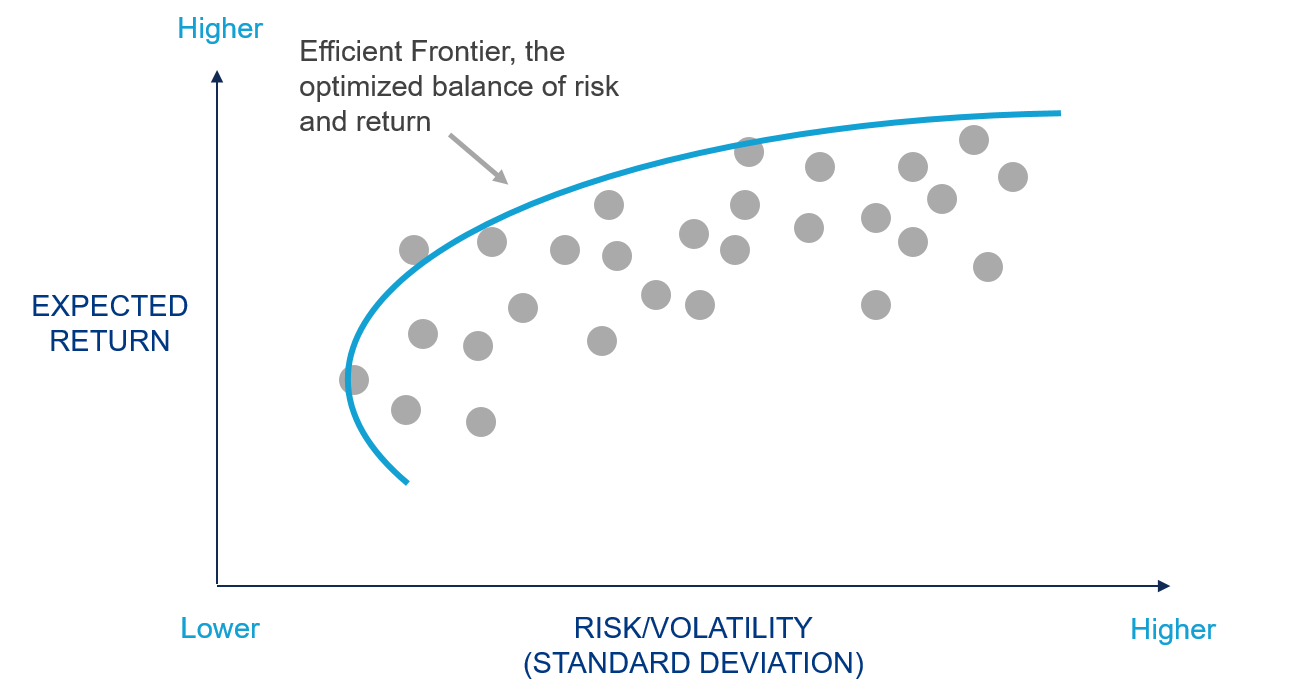

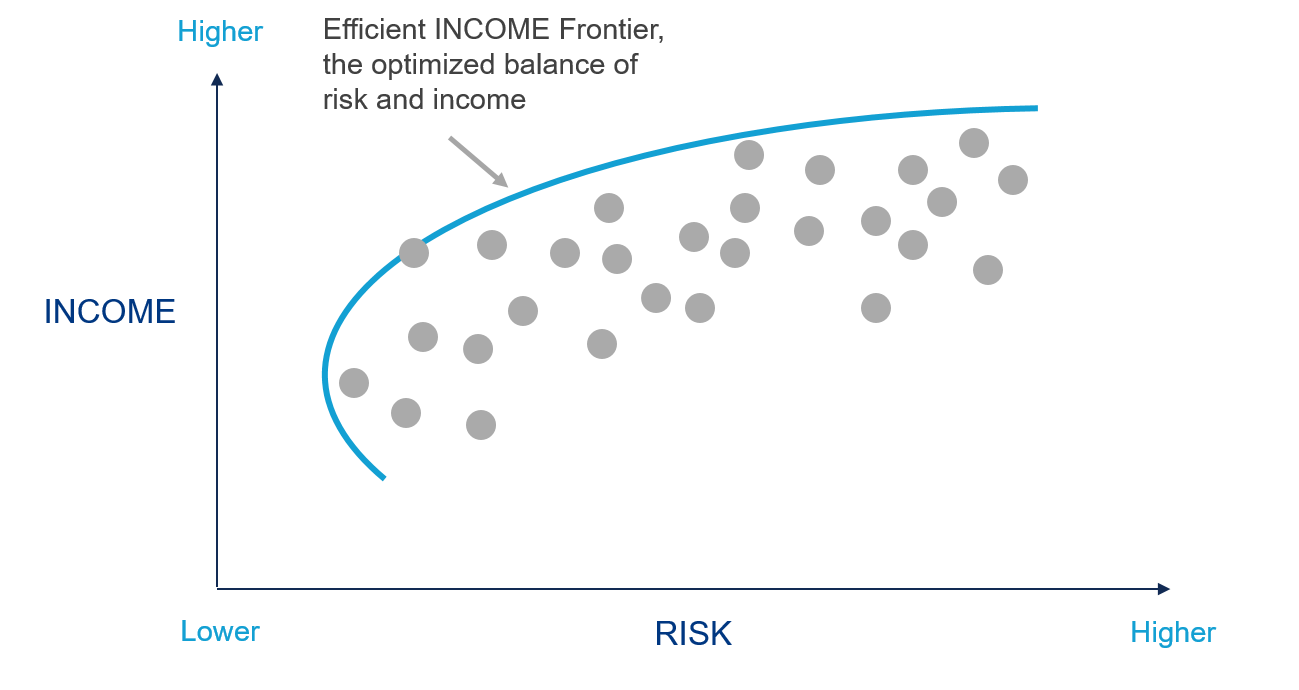

Introducing the Efficient Income Frontier

Generating secure income to meet our retirement goals while navigating uncertainty is a challenge. To help participants looking for some level of protection in their retirement income to meet at least their basic expenses such as housing, health care, utility bills, and groceries, we need to shift from an accumulation to a decumulation mindset.